Individual

Wills and Caring for the Vulnerable

Our specialist Private Client team at Dean Wilson advises on the preparation of Wills and Lasting Powers of Attorney, Tax Planning, Trusts and the Administration of Estates. During the challenging period after a loved one's passing, we provide a compassionate and efficient service for probate or administration, addressing issues like intestacy, inheritance tax, and estate variations with a friendly and approachable approach.

Will Services

Will Solicitors & Writing Services

We are experts in tax advice and estate planning, and can help you reduce your tax liability, both now and in the future. Our people are very experienced in advising high-net-worth clients and are used to dealing with complex Estates. Given the importance of a properly drafted Will, we take great care in ensuring you receive the best possible advice. We are also well-placed to undertake and advise on issues like Deputyship, Statutory Wills and Lifetime Gifting.

In the difficult time period following the death of a relative or friend, we provide an efficient service to smooth the process of probate or administration; dealing with issues such as intestacy, inheritance tax and any variations in the Estate. Because this is can be a deeply emotional time, we ensure everything is handled in an approachable and friendly way.

Wills and Caring for the Vulnerable

Our solicitors in Brighton offer several services including:

Preparing your Will to provide for your family and loved ones is of vital importance, not only to ensure that they receive what you wish them to but also to ensure your Estate is maximised by taking tax planning advice. Intestacy on the other hand can cause great heartache and badly planned Wills can lead to disputes causing delay and expense to your Estate. Although preparing a Will is sometimes a difficult matter to contemplate, we can assist you in ensuring that the future for your loved ones is well planned for. For some people, Living Wills may be of comfort, allowing an individual of sound mind to indicate circumstances in which they do or do not wish to continue medical treatment and giving them the opportunity to appoint a Healthcare Proxy to make decisions on their behalf.

A Lasting Power of Attorney can relate to both health and care decisions and financial decisions, allowing you to appoint someone to make those decisions on your behalf. Without a Lasting Power of Attorney it would be necessary to apply to the Court of Protection for a Court-appointed Deputy to act when you are unable to if you lack capacity to make decisions yourself. Applications to the Court of Protection can be lengthy and expensive. A power of attorney can help you avoid this cost. Our solicitors can assist you in avoiding those expenses and delays and to simplify matters for you in the future, thereby providing great comfort to you and your family in times of need.

A ‘personal injury trust’ or a ‘special needs trust’ is a form of trust. We can assist in setting up a personal injury trust.

A trust is a relationship that is recognised and enforceable in the courts. Where there is an award of compensation for a personal injury, a trust arises for the injured person when that award is put under the control of other persons (the trustees).

By putting your compensation for your personal injury into a trust you should be able to retain your entitlement to state benefits.

Your trustees can look after your property in the trust even if you cannot. That may be particularly important later in life.

Your trustees can help share the burden of sorting out your paperwork which naturally arises when money is invested.

As well as preparing Wills and Powers of Attorney, we can assist with the protection of the family home, lifetime gifts, nursing home fee planning and personal income tax. We aim to assist in the smooth running of personal matters at some of the most difficult times for families so it is one less thing for you to worry about.

Whether purchasing a new home together with someone else or undertaking complex gifts or tax planning measures, it is quite common to wish to hold property between people in differing shares. This is commonly undertaken with a ‘bare trust’ through a document usually called a Declaration of Trust or a Deed of Trust. We are familiar and experienced with such documents including the potential pitfalls, risks and tax consequences for clients and shall be happy to advise on how to keep your shares protected.

Factsheets

Browse and download

Wills Factsheet

Lasting Power of Attorney

Personal Injury Trusts

Declaration of Trust

Your Wills and Caring for the Vulnerable experts

Get to know those who are here to help you

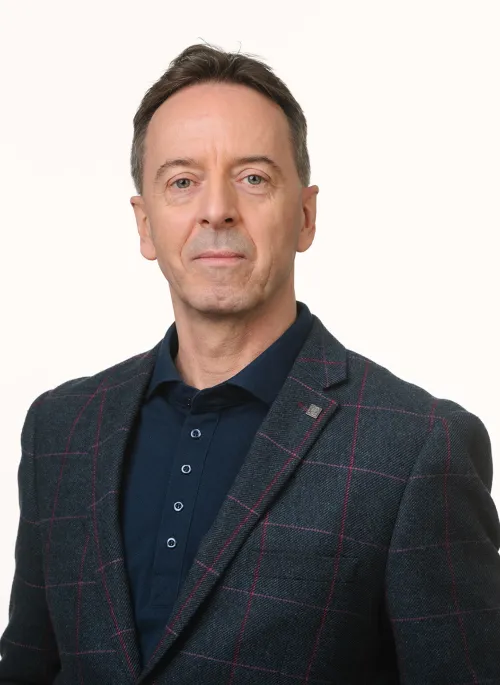

Julian Potter

Solicitor, Private Client

Areas of Specialism

Julian has over 20 years’ experience as a solicitor dealing with all aspects of Private Client work including Wills, Lasting Powers of Attorney, Administration of Estates and Estate Planning.

Julian can advise on a variety of Wills to suit differing circumstances including advising on various types of trusts for efficient tax planning and asset protection.

Julian deals with a variety of estates of all values including intestacies and estates with business interests and can provide a service tailored to your needs whether it be obtaining the Grant of Probate or dealing with the administration of the entirety of the estate.

Julian can advise on Estate Planning matters including Inheritance Tax saving, the Inheritance Tax Nil Rate Band, the Residence Nil Rate Band and preservation of the same as well as providing Capital Gains Tax advice.

Julian always aims to forge a close relationship with his clients in trying to provide the best service and advice for them.

Khushi Kanodia

Trainee Solicitor, Private Client

Areas of Specialism

Khushi is a dedicated trainee solicitor who is passionate about assisting clients in effectively navigating legal challenges.

She has gained valuable experience in our Personal & Medical Injury and Commercial Property teams as a paralegal where she contributed to various complex legal matters. As a trainee, Khushi is enjoying working within the Private Client team and is committed to continuously developing her skills.

In addition to English, being fluent in Hindi allows Khushi to communicate effectively with a diverse range of clients.

Qualifications

- SQE

- LLB Hons