Individual

Wills, Trusts and Probate

Plan with confidence. Protect what matters most.

At Dean Wilson LLP, we help individuals and families across Brighton, Hove, and Sussex secure their futures through expert will writing, estate planning, probate administration, and legal support for vulnerable and elderly individuals. Whether you’re writing your first will, managing a loved one’s estate, or planning for later life, our experienced solicitors are here to guide you with clarity and compassion.

Our services at a glance

We offer a complete range of private client legal services:

Making a will is one of the most important steps you can take to protect your loved ones and ensure your wishes are followed. A professionally written will ensures:

- Your assets go to the people or causes you care about

- Guardians are appointed for your children

- Disputes and delays are reduced

- Inheritance tax is managed efficiently

Our experienced solicitors will help you create a will that is clear, legally valid, and tailored to your personal circumstances. We’ll also ensure it stays up to date as your life and priorities change.

We can help with:

- Drafting and updating wills to reflect life changes

- Appointing trusted executors and guardians

- Structuring your estate to reduce inheritance tax

Without a will, the law decides who inherits your estate, which may not reflect your intentions. Whether you're making a will for the first time or reviewing an existing one, we provide trusted legal advice to give you peace of mind.

Start Your Will Online

Getting started is quick and easy. Complete our secure online form and a member of our team will be in touch to guide you through the next steps.

Start your Will online.

Prefer to speak to someone? Call us on: 01273 249 200

Our team provides strategic advice to help reduce your inheritance tax liability and maximise the assets passed on to loved ones, using tried-and-tested approaches tailored to your financial situation.

We advise on:

- Using allowances and exemptions effectively

- Lifetime gifting strategies

- Protecting family wealth through trusts

Trusts offer long-term control over how your wealth is managed and distributed. We’ll guide you in choosing and setting up the right structure to meet your family’s needs and goals.

- Discretionary trusts to manage wealth flexibly

- Bare trusts for gifts to children

- Life interest trusts to support a partner while preserving capital

- Declarations of Trust (Deeds of Trust) – commonly used when people purchase a property together in unequal shares or where gifts are made between family members. We are experienced in drafting these documents and advising on the risks, tax implications and how best to protect your share.

- Personal Injury Trusts – these trusts are used to protect compensation awards. By placing a personal injury award in trust, individuals can preserve their entitlement to means-tested benefits. Trustees can also assist in managing the funds and associated paperwork, offering peace of mind for the future.

Dealing with the loss of a loved one is difficult. Our team provides practical, compassionate support to executors and families, helping manage the legal and administrative responsibilities from start to finish.

- Applying for the grant of probate

- Collecting and valuing assets

- Distributing the estate in line with the will or intestacy rules

- Handling inheritance tax forms and payments

Disagreements about a will or estate can be distressing and complex. Our solicitors provide sensitive, expert support in resolving disputes, whether through negotiation, mediation or litigation, always aiming to protect your rights and achieve a fair outcome.

- Challenging or defending the validity of a will

- Inheritance Act claims for reasonable provision

- Executor or trustee disputes

- Claims of undue influence or lack of capacity

An LPA gives you peace of mind that someone you trust can step in if you’re unable to make decisions yourself. We make the process straightforward, guiding you through each step of appointing attorneys.

- Property & Financial Affairs LPA – for bills, property and finances

- Health & Welfare LPA – for care and medical decisions

- Help with applying to become a court-appointed deputy

- Support with managing finances and healthcare decisions

- Acting as a professional deputy where appropriate

If someone has lost capacity and doesn’t have an LPA, we help families navigate the Court of Protection process and provide long-term support in managing their affairs sensitively and responsibly. You can see more information on our Court Of Protection Services Pages.

- Protecting the family home from unnecessary risk

- Making tax-efficient lifetime gifts

- Planning for potential nursing home fees

- Personal income tax issues

- Setting up trusts for long-term security

- Managing finances and property for vulnerable individuals

Supporting elderly and vulnerable clients goes beyond wills and LPAs. We offer holistic advice to protect assets, manage day-to-day financial matters, and reduce stress for families navigating complex legal and care situations. You can also see further information on our Court of Protection Services Page

Free Downloadable Factsheets

Browse and Download

Looking for more detailed information before speaking to a solicitor? Our free downloadable factsheets provide straightforward guidance on:

- Making a will and choosing executors

- Understanding Lasting Powers of Attorney

- Understanding a Declaration of Trust

- Personal Injury Trusts

Each guide is designed to answer common questions and help you make informed decisions. Download them from our website or contact us for printed copies.

Wills Factsheet

Lasting Power of Attorney

Personal Injury Trusts

Declaration of Trust

Why choose Dean Wilson LLP?

- Local experts: Based in Brighton, we’ve supported Sussex families for decades

- Compassionate advice: We listen, explain clearly and tailor our service to your needs

- Transparent pricing: No surprises - just fair, clear costs for quality legal work

FAQs about Wills, Trusts and Probate

A solicitor ensures your will is legally valid, clearly written and properly executed. This reduces the risk of disputes or errors.

Your estate will be divided under UK intestacy laws. This may leave out loved ones or cause avoidable complications.

Yes. A well-structured will and estate plan can help you pass on more of your assets by minimising unnecessary tax.

A will sets out how your assets are distributed when you die. A trust can be used during your lifetime or after death to manage money or property under specific terms.

Probate is the legal process of dealing with someone’s estate after they die. It’s usually needed when the deceased owned property or had assets in their sole name.

Your Wills and Caring for the Vulnerable experts

Get to know those who are here to help you

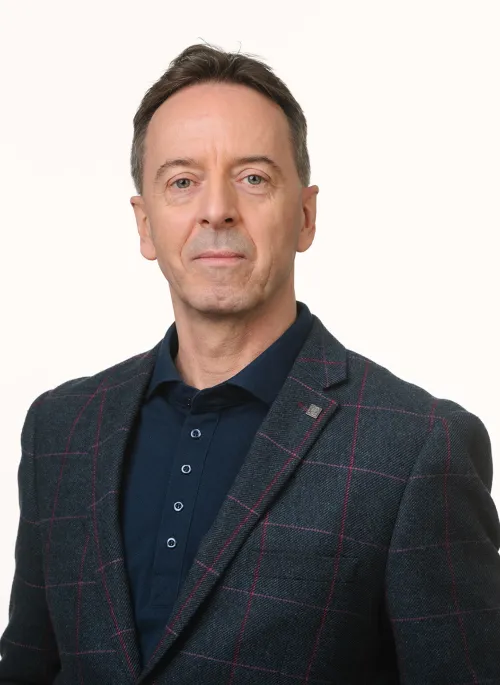

Julian Potter

Senior Associate Solicitor, Private Client

Areas of Specialism

Julian has over 20 years’ experience as a solicitor dealing with all aspects of Private Client work including Wills, Lasting Powers of Attorney, Administration of Estates and Estate Planning.

Julian can advise on a variety of Wills to suit differing circumstances including advising on various types of trusts for efficient tax planning and asset protection.

Julian deals with a variety of estates of all values including intestacies and estates with business interests and can provide a service tailored to your needs whether it be obtaining the Grant of Probate or dealing with the administration of the entirety of the estate.

Julian can advise on Estate Planning matters including Inheritance Tax saving, the Inheritance Tax Nil Rate Band, the Residence Nil Rate Band and preservation of the same as well as providing Capital Gains Tax advice.

Julian always aims to forge a close relationship with his clients in trying to provide the best service and advice for them.

Julian can be contacted by email: JP@deanwilson.co.uk or on their direct dial: (0) 1273 249219.

Rebecca Griffiths

Solicitor, Private Client

Areas of Specialism

Rebecca qualified into the Private Client team in 2019 after completing her training contract with Dean Wilson LLP. Rebecca studied the LPC at BPP Holborn London after studying Law LLB at the University of Nottingham. Rebecca is working towards full membership with the Society of Trusts and Estate Practitioners (STEP) and has further qualifications in Administration of Estates, Administration of Trusts and Taxation of Trusts and Estates.

Rebecca has experience in dealing with:

- Wills

- Trusts

- Probate

- Tax

Rebecca can provide advice on the best type of Wills taking account of a client’s personal circumstances, tax position and inheritance planning.

Rebecca has a broad range of experience in probate cases including high value probates, intestacies, Ad Colligenda Bona (limited grants usually required for the quick sale of property), and fractious families.

Qualifications and Memberships

- Solicitor

- LLB

- Affiliate of STEP

Rebecca can be contacted by email: RCG@deanwilson.co.uk or on their direct dial: (0) 1273 249280.

Ashleigh Sagar

Chartered Legal Executive, Private Client

Areas of Specialism

Ashleigh has worked at Dean Wilson LLP for 8 years and specialises in a range of Private Client matters.

Having completed her CILEX qualification in 2021, Ashleigh has grown within the department and has experience in dealing with all aspects of Private Client work including Estate Administration, Wills and Lasting Powers of Attorney.

Ashleigh always supports her clients with sensitivity and expertise.

Qualifications

Chartered Legal Executive (FCilex) 2021.

Ashleigh can be contacted by email: AHS@deanwilson.co.uk or on her direct dial: (0) 1273 249275.

Nikki Rudland

Senior Paralegal, Private Client

Areas of Specialism

Nikki has been with Dean Wilson for over 10 years working across various departments and most recently in Private Client specialising in wills, probate, estate administration, and lasting powers of attorney.

Prior to joining Dean Wilson, Nikki has experience working with another local law firm, the Brighton & Hove City Council and the Victim Support Unit and HR departments of Sussex Police.

Nikki has a wealth of knowledge and over the years has built strong client relationships and developed a deep understanding of sensitive, high-value matters. Nikki supports solicitors and clients with particular emphasis on providing one-to-one assistance with regards to assisting clients in relation to Probate/Estate Administration, Wills and LPAs.

Nikki can be contacted by email nr@deanwilson.co.uk; or on her direct dial: 01273 249216

Contact the Wills and Caring for the Vulnerable Department

Enter your details below

Read our Latest News

On Wills and Caring for the Vulnerable Services

What is the Court of Protection?

The Court of Protection makes decisions for people who lack the mental capacity to manage their own affairs, such as finances or healthcare. If no Lasting Power of Attorney is in place, it can appoint a deputy, usually a family member or professional, to act on their behalf.